Government Accountability and Oversight

Is this among the millions that foundations are providing to a ‘contingency fee’ tort firm? Did tort firm disclose to politician clients? Did politicians disclose to legislatures and taxpayers?

In 2020, information surfaced in IRS Forms 990 filed by the non-profit Resources Legacy Fund (“RLF”) suggesting that the ‘climate nuisance’ and ‘consumer fraud’ lawsuits filed by Sher Edling, LLP on behalf of progressive attorneys general officials and local governments, were being privately financed to the tune of millions of dollars.

“Charitable grants” of millions of dollars to a plaintiff’s tort firm are certainly unusual. This was particularly curious given the politicians hired Sher Edling with contingency fee contracts promising them tens of millions in the event they prevail, because the governments couldn’t afford to pay the firm and the firm took the risk in making the investment in the cases unsure of a payday.

“Deception may make for a good story on the big screen, but this new evidence raises some very troubling questions outside of Hollywood. Are well-heeled donors secretly funding government litigation by attorneys who are also seeking a second, multi-million dollar payday from the taxpayers?”

One law professor, Michael Krauss of George Mason University, raised questions about the arrangement, in Forbes.com. Indeed, if the money given to the law firm at the same time the lawsuits began being filed was for those lawsuits, then the non-profit obscured that fact with misleading language. The grants were officially reported as supporting “land or marine conservation” (2017) ($432,129), then as “advancing healthy communities” (2018) ($1,319,625) then, apparently having run out of euphemisms, as supporting “land or marine conservation, promotion of education and/or healthy communities” (2019) ($1.1 million).

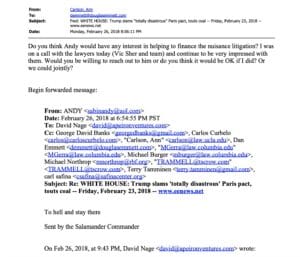

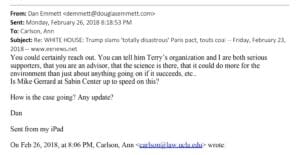

Nonetheless, emails just obtained by Government Accountability & Oversight in open records litigation in California after a two-year legal battle at least confirm that private parties were in fact “serious supporters” underwriting the litigation (and presumably still are). These include Leonardo DiCaprio who, a review of his foundation’s IRS filings suggest, routed his group’s funding through at least one other organization.

So, Terry [Tamminen]’s group — at the time Tamminen was CEO of the Leonardo DiCaprio Foundation — and Dan Emmett are “strong supporters” of the Sher Edling litigation. And their colleague om several environmentalist enterprises, major Republican ‘green’ donor Andy Sabin was targeted to possibly help fund the assault, too.

It is possible that the “serious support” for “the nuisance litigation” was funneled into RLF’s $3 million that has so far been reported. However, Emmett’s foundation’s 990s (and his word choice) suggest this was personal money or, if it was from his own foundation, then that money too may have been routed through at least one other organization. Likely conduits for that latter task, from the various 990s, include Rockefeller Philanthropy Advisors and Sustainable Markets Foundation, even the University of California.

This new revelation raises further, serious ethical as well as public policy questions. Among them: what’s with the contingency fee pacts promising lawyers a substantial share of a claimed hundreds of millions of dollars in supposed losses by the taxpayers in the plaintiff jurisdictions when the firm isn’t, in fact, taking the suggested risk/investing on its own lots of uncompensated time on a suit that may never pay? Do the clients and the taxpayers they represent know about this?

Notably, there is no indication from these records or other such correspondence obtained under open records laws that this “serious support” is litigation finance for a stake, just donors ponying up to finance the cases as a cause.

Consider Minnesota. There, the firm’s contract had to be approved by a Legislative Advisory Commission as a good government measure. The Minnesota AG’s contract with Sher Edling states, in toto, re compensation for the work:

6. COMPENSATION AND EXPENSES. Special Attorneys shall be compensated for the performance of their duties under this appointment and shall be reimbursed for certain costs and disbursements (together “costs”) in the manner set forth in the Fee Agreement which is attached as Exhibit A and incorporated herein.

If the firm is being paid on the side from other sources, it is difficult to see how that fits within this representation.

Did the law firm disclose to Minnesota Attorney General Keith Ellison that it was already being paid to conduct this litigation, when negotiating with his Office to take upwards of tens of millions of dollars from damages that Ellison claims Minnesota taxpayers have suffered?

That is, did the Commission know this when it approved the contract as a good-government watchdog? If not, possibly Professor Krauss could update his thoughts on these arrangements.

But if the firm did make this disclosure of the private financing for Minnesota’s litigation, then taxpayers (and the Legislative Advisory Commission) might wonder whether Ellison informed the Commission of the full financial arrangements when he sought approval for his Sher Edling contingency fee contract. Because that disclosure doesn’t appear in the materials released under Minnesota’s open records law (scroll about 70% of the way down).

Taxpayers in each plaintiff jurisdiction might have similar questions about disclosure, and the appearance of double-dipping under the arrangement.

Another concern arises from this most unusual of funding arrangements, by which millions are quietly being paid to underwrite the litigation even though millions have been promised to the firm to pay for the litigation, as a “risk premium”. This concurrent funding program suggests that the objective may not be to carry matters to successful trial or settlement; possibly, success is viewed as putting the targets through the costs of the litigation process itself and through the burdens of civil discovery.

“Making the process the punishment,” as the saying goes, in the form of terribly expensive legal and public relations battles (whose costs are paid by shareholders and consumers), and reputational damage, all while supporting the political movement to terminate the targeted industries.

Noting that DiCaprio’s Foundation website boasts of all manner of grants yet makes no mention of its “serious support” for financing the “climate nuisance” production which has managed to attain broad distribution, opening in dozens of venues across the country, GAO board member Matthew Hardin commented, “Deception may make for a good story on the big screen, but this new evidence raises some very troubling questions outside of Hollywood. Are well-heeled donors secretly funding government litigation by attorneys who are also seeking a second, multi-million dollar payday from the taxpayers?”

Thanks to records obtained only after two years of litigation in California, there are numerous, important questions calling out for answers. It is up to policymakers and media to demand them.